Sustainability Overview

Policies and Goals on Sustainable Management

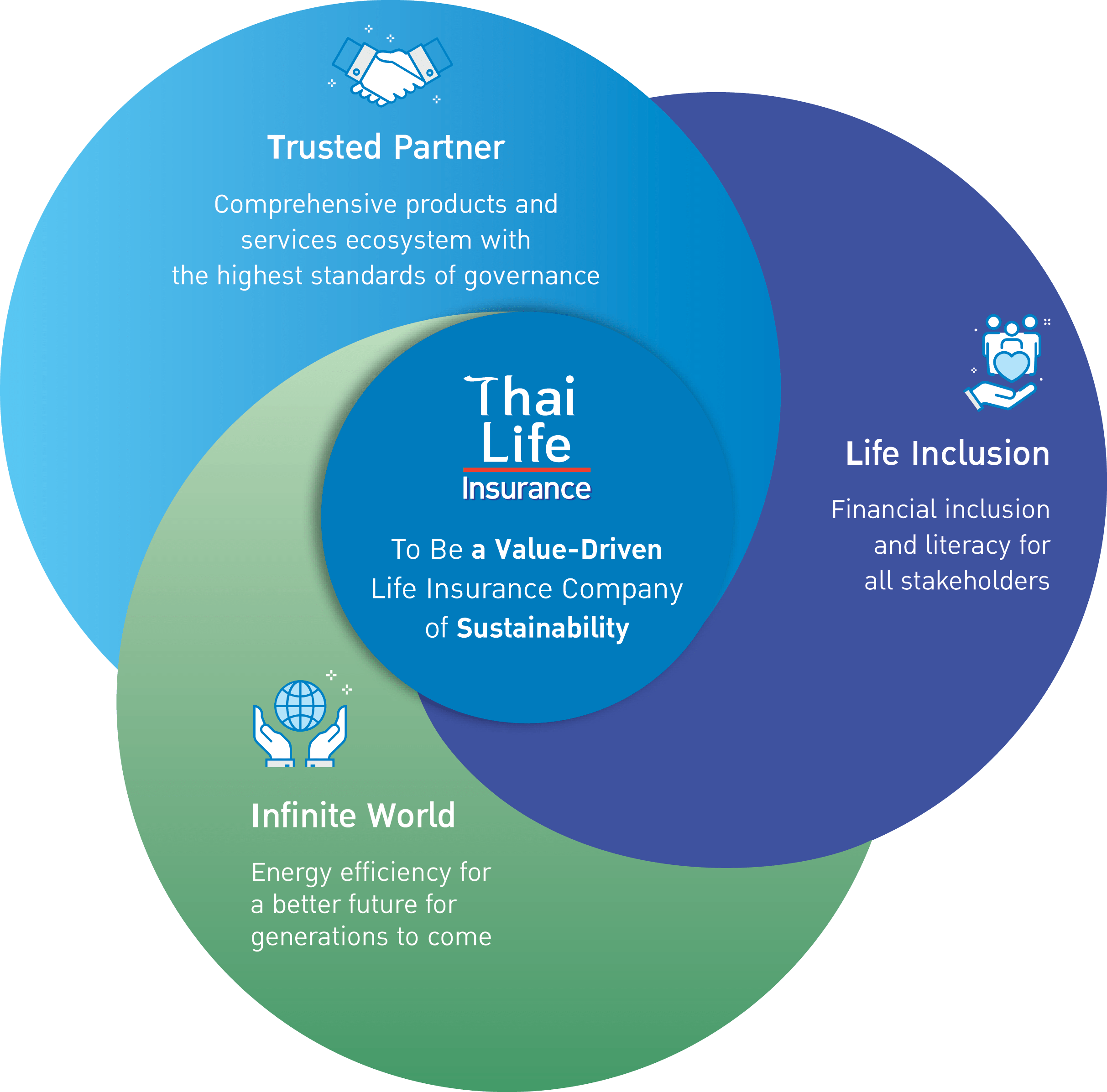

TLI realizes the importance of social responsibility, environment, and stakeholders in the business value chain, including the importance of being an organization which is concerned of Environmental, Social, and Governance or ESG on the basis of profit optimization and sharing some profits back to the society to make TLI and Thai society to grow sustainably together. TLI has prepared the Sustainable Development Master Plan based on Sustainable Development Goals: SDGs of the United Nations which in accordance with the UN Global Compact Guidelines, comprising of 3 core strategies namely;

Under “TLI Sustainability Strategy and Framework”

- Initiated and developed a product for low-income customers’ accessibility.

- Increased the opportunity for accessing healthcare services.

- Provided and promoted knowledge of financial and life insurance management.

- Organized workshop/training on skill and knowledge development to increase communities’ income.

- Promoted occupational health and safety.

- Promoted awareness and availability of effective health service.

- Organized donations of medical equipment or medical assistance activities.

- Promoted public relations and donation campaigns for health-related foundations.

- Enhanced co-operation for financial and life insurance planning program.

- Launched savings insurance products and financial planning.

- Provided capacity development for personnel and life insurance agents.

- Organized training on vocational skills development and financial management for communities.

- Supported programs/activities on promoting quality of education for youth.

- Non-discrimination against people with differences and inferiors: sex, race, skin color, ethnicity, religion, and origin.

- Offered health insurance covering healthcare for pregnant women.

- Increase the share of using renewable energy in the organization.

- Enhance the energy efficiency rate in the organization.

- Provided fair employment which is more accessible to local people.

- Enhanced skill in ecosystem business management for communities.

- Employed persons with disabilities.

- Built a good working environment.

- Develop quality, reliable, and easily accessible infrastructure to support economic development and the well-being of stakeholders.

- Enhance access to information technology, communications, and financial services for individuals, enterprises, and industries to better integrate them into the value chain and market.

- Improve business processes through more efficient resource utilization and more environmentally friendly technology.

- Provided nationwide service channels and various customized financial planning and life insurance products for wide-ranging customers.

- Provided accessibility to financial and insurance literacy.

- Create channels that can reach society and provide comprehensive services as well as supporting economic, social, and environmental connectivity in urban, peri-urban, and rural areas.

- Reduce the negative impacts of urbanization on the environment by improving air quality management and enhancing the efficiency of clean energy in business operations.

- Effectively consumed energy as a way to alleviate the impact of climate through an environmentally-friendly operation.

- Raised awareness of environmentally-friendly among employees.

- Committed to conducting business based on good corporate governance and ethics.

- Create awareness of social responsibility and transparency at all levels

- Ensure that the Company’s confidential information is securely stored, in accordance with the law.

- Promote the policy of non-discrimination for sustainable development.

- Promoted effective cooperation of external partnerships among the government, private, and civil society sectors.

Based on the attachment of societies through projects and activities that help raise their awareness of the importance of 'Giving'.

Based on the commitment to strengthening and caring societies, starting from managing personnel in the organization through fair remuneration and allocation of welfare, and developing comprehensively need-based products and services for insureds.

Based on fulfilling and inspiring personnel to build their value and value in others, also conceptualizing being a 'Giver' through volunteering activity to help boost well-being in a society.